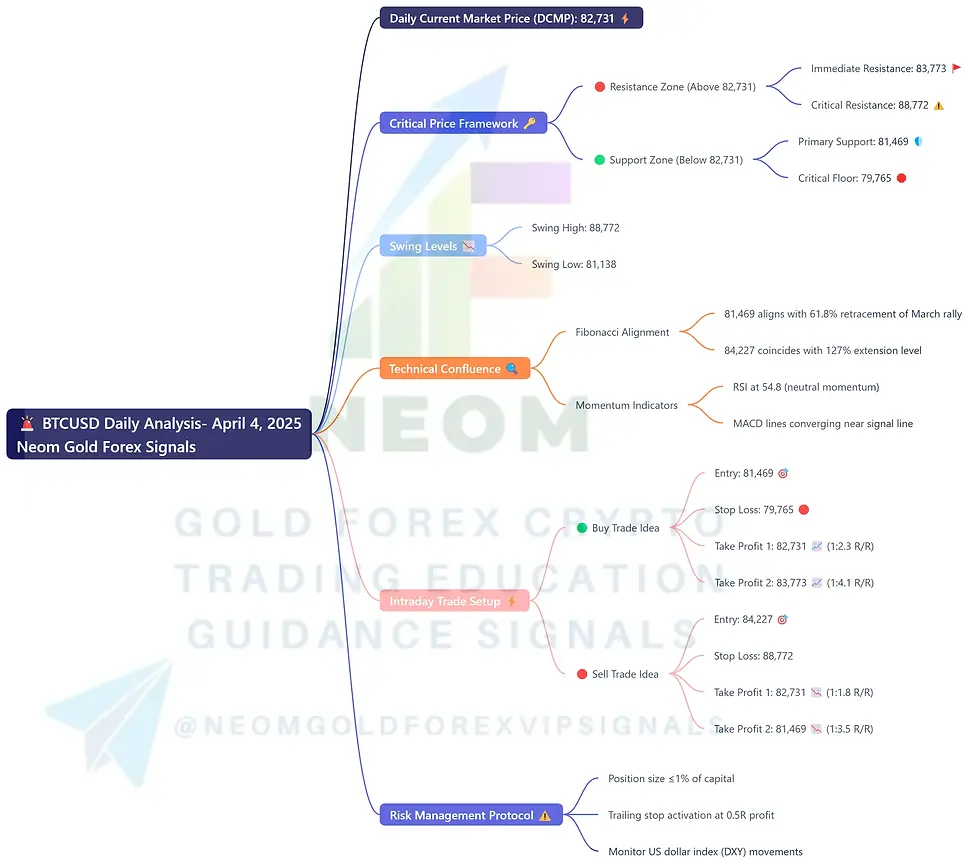

🚨 BTCUSD Daily Analysis Based on Main Key Levels - April 4, 2025

- Neom

- 5 hours ago

- 1 min read

Daily Current Market Price (DCMP): 82,731 ⚡

Critical Price Framework 🔑

🔴 Resistance Zone (Above 82,731)

Immediate Resistance: 83,773 🚩

Critical Resistance: 88,772 ⚠️

🟢 Support Zone (Below 82,731)

Primary Support: 81,469 🛡️

Critical Floor: 79,765 🛑

Swing Levels 📉

Swing High: 88,772

Swing Low: 81,138

Technical Confluence 🔍

Fibonacci Alignment

81,469 aligns with 61.8% retracement of March rally

84,227 coincides with 127% extension level

Momentum Indicators

RSI at 54.8 (neutral momentum)

MACD lines converging near signal line

Intraday Trade Setup ⚡

🟢 Buy Trade Idea

Entry: 81,469 🎯

Stop Loss: 79,765 🔴

Take Profit 1: 82,731 📈 (1:2.3 R/R)

Take Profit 2: 83,773 📈 (1:4.1 R/R)

Rationale: Strong support confluence at Fibonacci 61.8% level with bullish divergence on 4H chart.

🔴 Sell Trade Idea

Entry: 84,227 🎯

Stop Loss: 88,772

Take Profit 1: 82,731 📉 (1:1.8 R/R)

Take Profit 2: 81,469 📉 (1:3.5 R/R)

Rationale: Resistance cluster at weekly pivot (84,227) with bearish RSI divergence on daily chart.

Risk Management Protocol ⚠️

Position size ≤1% of capital

Trailing stop activation at 0.5R profit

Monitor US dollar index (DXY) movements

Analysis valid until UTC 23:59. Chart patterns verified via TradingView.

Comments