📈 US30 Daily Analysis Based on Main Key Levels – April 3, 2025

- Neom

- 4 days ago

- 1 min read

Daily Current Market Price (DCMP): 41,303 🔄

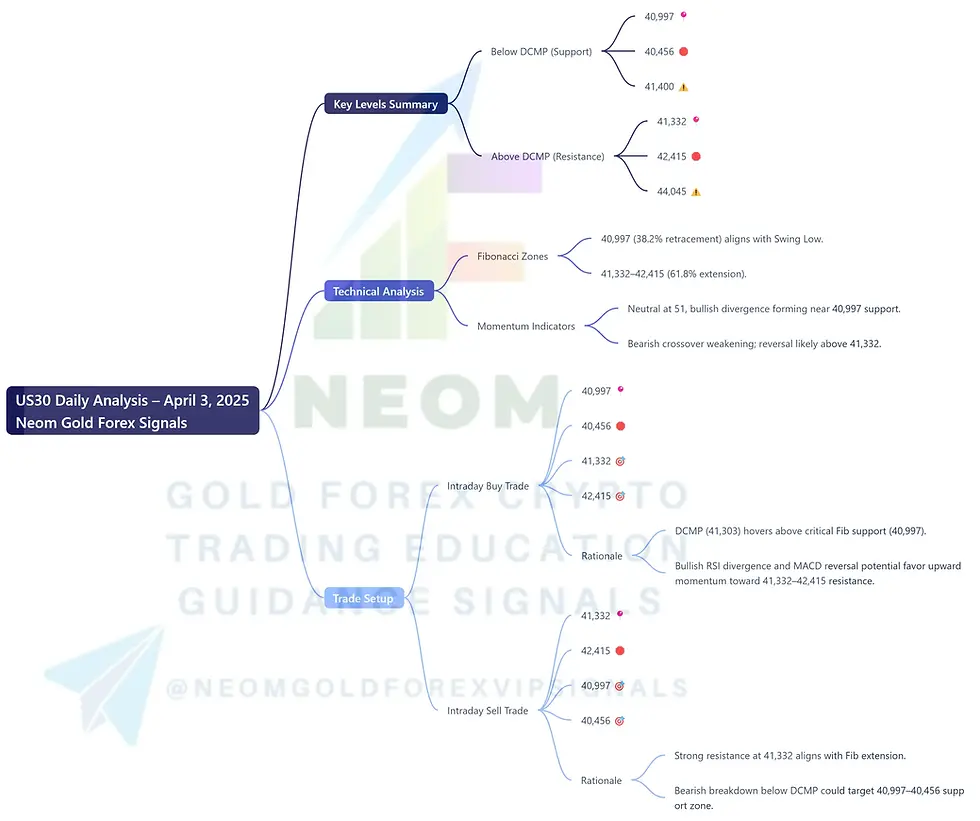

🗝️ Key Levels Summary

Below DCMP (Support)

Immediate Support: 40,997 📍

Strong Support: 40,456 🛑

Swing Low (4H/Daily): 41,400 ⚠️

Above DCMP (Resistance)

Immediate Resistance: 41,332 📍

Strong Resistance: 42,415 🛑

Swing High (Daily): 44,045 ⚠️

🔍 Technical Analysis

1️⃣ Fibonacci Zones:

Critical Fib support at 40,997 (38.2% retracement) aligns with Swing Low.

Resistance cluster at 41,332–42,415 (61.8% extension).

2️⃣ Momentum Indicators:

RSI: Neutral at 51, bullish divergence forming near 40,997 support.

MACD: Bearish crossover weakening; reversal likely above 41,332.

💡 Trade Setup

✅ Intraday Buy Trade

Entry: 40,997 📍

Stop Loss: 40,456 🛑

Take Profit 1: 41,332 🎯

Take Profit 2: 42,415 🎯

Rationale:

DCMP (41,303) hovers above critical Fib support (40,997). Bullish RSI divergence and MACD reversal potential favor upward momentum toward 41,332–42,415 resistance.

❌ Intraday Sell Trade

Entry: 41,332 📍

Stop Loss: 42,415 🛑

Take Profit 1: 40,997 🎯

Take Profit 2: 40,456 🎯

Rationale:

Strong resistance at 41,332 aligns with Fib extension. Bearish breakdown below DCMP could target 40,997–40,456 support zone.

📉 Critical Notes

Confirm trades with 4-hour closing prices above/below 41,303 DCMP.

Tighten stops if price breaches TP1.

🔔 Disclaimer: Analysis is educational. Verify strategies with independent research.

✨ SEO-Optimized Insights: Actionable US30 intraday trades with Fib levels and momentum indicators. Bookmark for daily strategy updates!

Comments