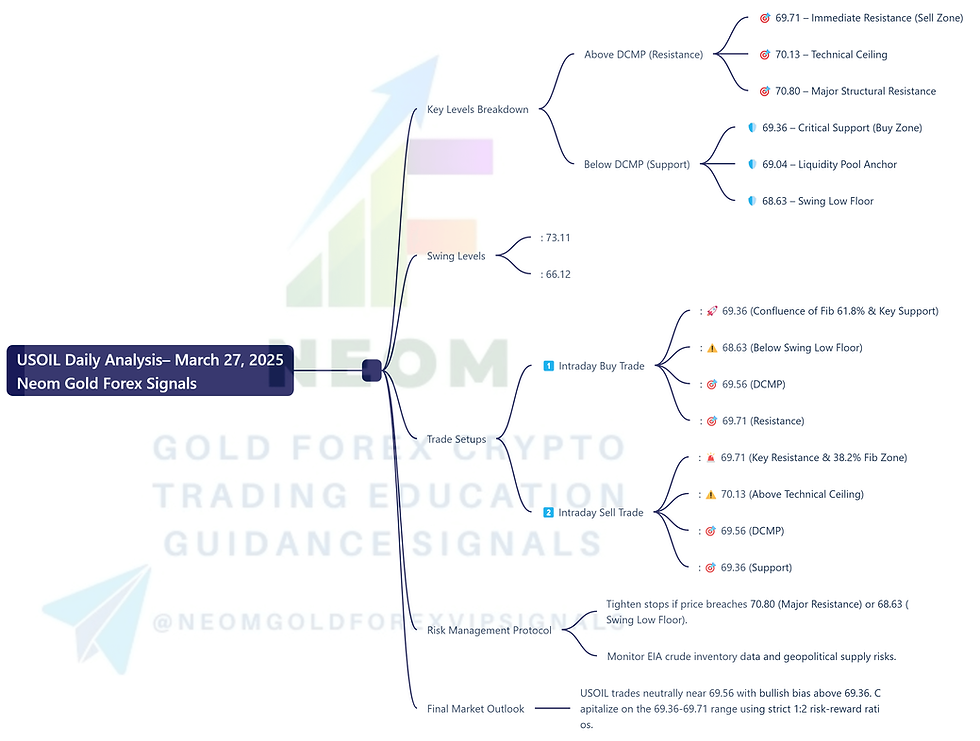

📈 USOIL Daily Analysis Based on Main Key Levels – March 27, 2025

- Neom

- Mar 27

- 1 min read

Daily Current Market Price (DCMP): 69.56

🔍 Key Levels Breakdown

Above DCMP (Resistance)

🎯 69.71 – Immediate Resistance (Sell Zone)

🎯 70.13 – Technical Ceiling

🎯 70.80 – Major Structural Resistance

Below DCMP (Support)

🛡️ 69.36 – Critical Support (Buy Zone)

🛡️ 69.04 – Liquidity Pool Anchor

🛡️ 68.63 – Swing Low Floor

📊 Technical Analysis Snapshot

Fibonacci Levels: Price consolidates between 38.2% Fib (69.71) and 61.8% Fib (69.36).

RSI: Neutral at 51, indicating balanced momentum.

MACD: Bullish crossover forming on 4-hour charts.

Swing Levels:

Daily Swing High: 73.11

Daily Swing Low: 66.12

💡 Trade Setups

1️⃣ Intraday Buy Trade

Entry: 🚀 69.36 (Confluence of Fib 61.8% & Key Support)

Stop Loss: ⚠️ 68.63 (Below Swing Low Floor)

Take Profit 1: 🎯 69.56 (DCMP)

Take Profit 2: 🎯 69.71 (Resistance)

Rationale: Strong bullish reversal potential at 69.36 with bullish MACD crossover and rising volume.

2️⃣ Intraday Sell Trade

Entry: 🚨 69.71 (Key Resistance & 38.2% Fib Zone)

Stop Loss: ⚠️ 70.13 (Above Technical Ceiling)

Take Profit 1: 🎯 69.56 (DCMP)

Take Profit 2: 🎯 69.36 (Support)

Rationale: Bearish rejection expected at 69.71 with RSI divergence and overhead supply pressure.

⚠️ Risk Management Protocol

Tighten stops if price breaches 70.80 (Major Resistance) or 68.63 (Swing Low Floor).

Monitor EIA crude inventory data and geopolitical supply risks.

📌 Final Market Outlook

USOIL trades neutrally near 69.56 with bullish bias above 69.36. Capitalize on the 69.36-69.71 range using strict 1:2 risk-reward ratios.

🔔 Correlate with Brent crude and DXY index for intermarket confirmation.

Comments